Did You Know?

We design Fincto for the readers, optimizing not for page views or engagement

We design Fincto for the readers, optimizing not for page views or engagement

Fincto revolutionizes ESOPs as a strategic tool for attracting, retaining, and incentivizing top talent. Our services include comprehensive consultation, ESOP schemes, and ongoing support. Partnering with Fincto fosters an ownership-oriented culture and high employee engagement.

Employee Stock Option Plans (ESOPs) empower employees to purchase company shares at predetermined prices, transforming them into stakeholders in the company’s growth trajectory and financial incentive.

ESOPs boost employee benefits as company value increases.

ESOPs reduce employee turnover and promote dedicated workforce.

Employees receive rewards for unwavering dedication.

ESOPs help companies maintain liquidity by avoiding major cash outflows.

Pros of ESOPs

ESOPs kindle a sense of ownership among employees, enhancing motivation and retention rates.

ESOPs provide tax advantages for companies and employees.

ESOPs offer non-cash compensation to conserve company cash.

Employees becoming shareholders may lead to diluted ownership and control.

ESOPs' effectiveness depends on market fluctuations, introducing risk.

Fincto's guidance helps manage ESOPs with administrative intricacies and costs.

E-commerce relies on efficient shipping and delivery; a Shipping Policy provides clear information on fees, timelines, and procedures, improving customer experience.

ESOPs vest for a specific duration.

Employees can buy company shares after vesting period.

Predetermined share quantity, pricing, and recipients.

Employees can purchase company shares at designated prices.

Verify organization's articles for ESOP provisions.

Notify committee members and shareholders about general meeting.

Conduct a general meeting for shareholder approval for ESOP issuance.

Create a Compensation Committee with independent directors.

Request shareholder approval through a separate resolution.

Ensure draft certificates are in place.

Complete Form-PAS-3 filing and Director Report (DR) disclosure.

Maintain a comprehensive ESOP register (SH-6).

Ensure entries in the register are duly authenticated.

ESOP eligibility follows IRS guidelines, with maximum 21-year entry age and immediate vesting plans for two-year service employees.

ESOP registration involves drafting rules, obtaining board and shareholder approvals, and filing form filings.

Crafting a strong ESOP framework is crucial.The process involves:

Develop detailed rules for options, exercise procedures, and exit consequences.

Acquire corporate approvals for ESOP rules and option pool establishment.

Approve ESOP rules, pool size, option granting, and share issuance.

Obtain waivers from shareholders with preemptive rights.

Prepare director resolutions for option grants.

Send grant letters and option certificates to recipients.

Record key option details in an internal option register.

Comply with reporting regulations as mandated.

Vendor agreements vary in terms and requirements.Here are some common types:

Tax on exercise price difference between fair market value.

Capital gains tax applies to share sales based on holding period.

Company-paid dividends are subject to tax.

ESOPs provide tax-efficient holding period strategies.

ESOPs motivate employees, Fincto’s expertise enhances benefits:

ESOPs offer employees reduced stock purchases, increasing financial motivation.

ESOPs provide employees a tangible stake in company success.

ESOPs offer tax benefits and diversification options.

ESOPs provide stable retirement funds with growth.

The process encompasses various stages:

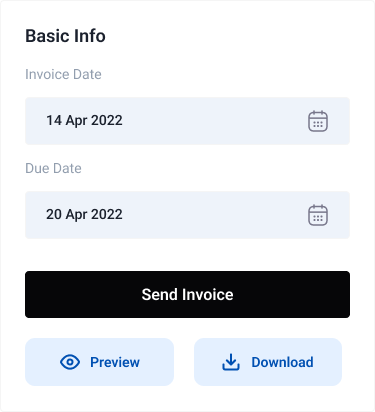

ESOP scheme details shares, exercise price, and vesting period.

Employees consider options post-vesting, requiring liquid shares availability.

Shares are allotted upon exercise, with prompt payment due.

Shares are transferred to employees' Demat accounts promptly.

Compliance with regulatory requirements for ESOP issuance and allocation.

Complying with SEBI regulations, including timely reports and disclosures.

India’s MOUs now operate within legal parameters with Fincto.:

Collaborate with Fincto's legal professionals to create a vendor agreement.

Agreement undergoes rigorous validation, approval from legal professionals, and dispatched via registered mail or courier.

Legal experts form a meticulous agreement, ensuring clarity on purpose, discussions, and dialogue.

THIS FOUNDERS’ AGREEMENT (hereinafter referred to as the ‘Agreement’) is executed on [DD/MM/YYYY] by and among [XXXX] (the ‘Company’), and the following founders (the ‘Founders’):

[Insert Founder Name]

[Insert Founder Name]

NOW, WITH DUE CONSIDERATION to the foregoing and the mutual covenants and agreements hereinafter detailed, the parties hereto concur as follows:

[Continuation of the founders agreement template, incorporating company information, initial capital, ownership structure, vesting schedule, intellectual property rights, amendment protocols, resignation procedures, confidentiality commitments, dispute resolution, and more.]

Fincto combines technology and legal expertise for thousands of legal tasks.

Government processes simplified for convenience.

Package includes two iterations for satisfaction.

Fincto simplifies legal processes, making them accessible and accessible.

For comprehensive guidance, expert consultation is recommended.

Customer may receive a refund for product dislike, damaged, incorrect item, or predefined issues upon return.

Refund policy governs online order cancellation process, details, and procedures for refunds.

A well-crafted contract securely stores user data and complies with terms.

Ethical service providers must communicate service conditions to clients.

Policies guide service provider-customer legal framework.

Legal contracts require integrated privacy policies for websites.

Privacy guidelines outline data collection, confidentiality, sharing, and collaboration.

Understanding policies ensures responsible online conduct, legal compliance, and user experience.

Comprehensive guide on vendor agreements, utilizing Fincto’s legal precision for effective deployment.

GSTR1 is the form used for tax returns on outward supplies, encompassing both interstate and intrastate B2B and B2C sales. It also includes details of purchases under reverse charge and inter-state stock transfers made during the tax period. Late filing of GSTR1 can result in a late fee, which is collected in the subsequent open return, Form GSTR-3B. Since January 1, 2022, taxpayers cannot file Form GSTR-1 if they haven't filed Form GSTR-3B in the preceding month.

This amendment form corrects any discrepancies between the GSTR-1 of a taxpayer and the GSTR-2 of their customers. The filing window for GSTR1A is between the 15th and 17th of the following month.

Monthly GST returns for inward supplies are filed using this form. It contains taxpayer information, return period, and detailed invoice-level purchase information related to goods and services separately.

This auto-generated tax return compiles purchases and inward supplies made by a taxpayer based on the information from their suppliers GSTR-1.

An auto-generated document that acts as an Input Tax Credit (ITC) statement for taxpayers, facilitating faster return filing, minimizing errors, easing reconciliation, and simplifying compliance.

This form is used to file consolidated monthly tax returns. It contains the taxpayers basic information, turnover details, final aggregate-level inward and outward supply details, tax liability under CGST, SGST, IGST, additional tax (+1% tax), ITC, cash, liability ledgers, and details of other payments like interests, penalties, and fees.

This is a tax notice issued by the tax authority to a defaulter who has failed to file monthly GST returns on time.

It is a temporary consolidated summary GST return for inward and outward supplies, introduced as a relaxation for recently registered businesses.

This quarterly GST return is filed by compounding vendors. It includes the total value of supplies made during the covered period and details of tax paid at the compounding rate (not exceeding 1% of aggregate turnover) along with invoice details for inward supplies.

The Quarterly purchase-related tax return filed by composition dealers, automatically generated by the GSTN portal based on information from the suppliers GSTR-1, GSTR-5, and GSTR-7.

Variable return for Non-resident foreign taxpayers, containing details of the taxpayer, return period, and invoice details of all goods and services sold and purchased. It also includes imports on Indian soil for the registered period/month.

This monthly GST return is for ISDs (Input Service Distributors), containing details of invoice-level supply from the GSTR-1 of counterparties, credit for ITC services received, debit for ITC reversed or distributed, and closing balance.

It is a monthly return for TDS (Tax Deducted at Source) transactions, containing the taxpayers basic information, return period, supplier's GSTIN, and invoices against which the tax has been deducted, categorized under SGST, CGST, and IGST. It also includes details of other payments like interests and penalties.

This is the monthly return for e-commerce operators. It contains the taxpayers basic information, return period, details of supplies made to customers through the e-commerce portal, tax collected at source, tax payable, and tax paid.

The annual consolidated tax return, comprising detailed income and expenditure, regrouped according to the monthly GST returns filed by the taxpayer.

The annual composition return form to be filed by every taxpayer enrolled in the composition scheme.

This Audit form is filed by taxpayers liable to get their annual reports audited when their aggregate turnover exceeds ₹2 crores in a financial year.

Filed before cancelling GST registration, this final GST return contains the details of all supplies, liabilities, tax collected, and tax payable.

Variable tax return for taxpayers with UIN (Unique Identification Number), containing details of purchases made by foreign embassies and diplomatic missions for self-consumption during a particular month.

LUT and bonds confirm exporter commitment, guiding when to opt for them and claiming IGST refunds for exports.

Staying compliant with GST due dates is vital to avoid late payment charges and interests. Fincto provides updated information on due dates for the financial years 2021-2022 and 2022-2023. Keeping clients informed of these updates can help taxpayers stay on top of their compliance requirements and ensure timely filing of GST returns.

A GST Certificate is an important document issued by the Indian government which proves that a business is registered under GST. The certificate contains crucial information like the GST identification number, name, and address of the business. With a GST Certificate on hand, businesses can easily charge and collect GST, apply for loans, and participate in tenders.

Fincto offers a holistic approach to ESOP implementation, focusing on strategic alignment, regulatory compliance, efficiency enhancement, and comprehensive end-to-end support. It streamlines processes, enhances experience, and provides comprehensive end-to-end support. Fincto’s ESOP expertise enhances employee ownership and engagement.

A modification to the existing provisions of a corporation's articles of incorporation

Issued by certifying authorities for electronic document signing.

The elected governing body responsible for a corporation's operation. Certificate of Incorporation: The document filed to create a corporation

A unique identification number for directors. Dissolution: The process that legally ends a corporation's existence

The act of forming a corporation under specific jurisdiction laws

An entity with limited personal liability and pass-through taxation

Protection from the debts and claims against a company

The process to secure exclusive use of a corporate name for a specific period

The statutory address of a corporation

Mattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Gerry Kellmen

Head of financeMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Johnson

WordPressMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Maxwell

PHP DeveloperMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Anderson

Head of financeBanca is a leading bank in the worldzone and a prominent international banking institution

COTATION

2023-01-05 14:00 (INTERNATIONAL TIME)