Did You Know?

We design Fincto for the readers, optimizing not for page views or engagement

We design Fincto for the readers, optimizing not for page views or engagement

The Goods & Services Tax (GST), introduced on 1 July 2017, is a landmark reform that transformed India’s indirect tax system.

Applicable to all service providers, traders, and manufacturers, GST replaced various Central and State taxes, unifying the taxation structure. Trust Fincto.io, your reliable partner, to navigate you through the complexities and formalities of GST registration.

GST comprises three tax components:

Levied by the Central Government on intra-state transactions.

Imposed by State Governments on intra-state transactions.

Applicable on inter-state transactions, collected by the Central Government.

The required documents vary depending on the type of business entity:

PAN Card and address proof of the proprietor.

PAN Card of LLP, LLP Agreement, and partners' names with address proof

Certificate of Incorporation, PAN Card of the company, AOA (Articles of Association), MOA (Memorandum of Association), resolution signed by board members, and identity and address proof of directors.

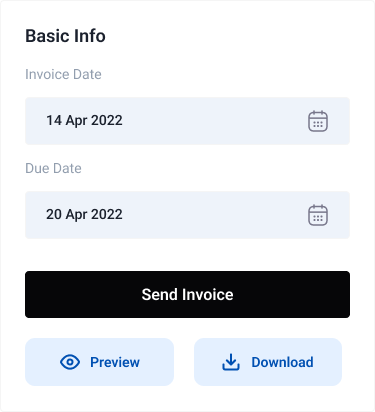

Follow these steps for smooth online GST registration:

GST registration is mandatory for the following entities:

A GST Certificate is an important document issued by the Indian government which proves that a business is registered under GST. The certificate contains crucial information like the GST identification number, name, and address of the business. With a GST Certificate on hand, businesses can easily charge and collect GST, apply for loans, and participate in tenders.

GST tax rates can range from 0% to 28% depending on the type of goods or services. essential items being taxed at 0%, while luxury items and certain services fall under the 28% bracket, gold is taxed at 3%, and crude oil and natural gas at 6%.Rates may vary, so it Is essential to check the current rates before transactions.

GSTIN (Goods and Services Tax Identification Number) is a unique identification number given to each GST taxpayer. It is used to verify GST registration on the GST portal.

According to Section 122 of the CGST Act, there is a direct penalty for taxable persons failing to register for GST online.

Companies with turnover below ₹20 lakhs can voluntarily register for GST, enjoying advantages like input credit, inter-state selling with no restrictions, registering on e-commerce platforms, and gaining a competitive edge.

GST return filing is the process of submitting details of sales, purchases, and taxes to the government. All registered taxpayers under GST must must file returns regularly, regardless of transactions during the period.

GST login process requires valid GST number and Indian mobile number.

Follow these simple steps to log in:

Visit GST portal and complete initial login step

Enter GST and mobile numbers for third step of Goods and services login.

Login to GST portal using mobile OTP, verifying sensitive information, and keeping registered number handy..

Log in to Goods and Services by clicking the Login tab.

Wait for OTP to proceed with GST portal login.

Final GST verification login redirects to GST dashboard for easy access to returns, invoices, and other relevant information.

Easy online GST registration service and GSTIN issuance.

Hassle-free compliance management, including return filing.

Expert assistance throughout the registration process and clear explanations of requirements.

A modification to the existing provisions of a corporation's articles of incorporation

Issued by certifying authorities for electronic document signing.

The elected governing body responsible for a corporation's operation. Certificate of Incorporation: The document filed to create a corporation

A unique identification number for directors. Dissolution: The process that legally ends a corporation's existence

The act of forming a corporation under specific jurisdiction laws

An entity with limited personal liability and pass-through taxation

Protection from the debts and claims against a company

The process to secure exclusive use of a corporate name for a specific period

The statutory address of a corporation

Mattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Gerry Kellmen

Head of financeMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Johnson

WordPressMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Maxwell

PHP DeveloperMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Anderson

Head of financeBanca is a leading bank in the worldzone and a prominent international banking institution

COTATION

2023-01-05 14:00 (INTERNATIONAL TIME)