Did You Know?

Advanced visual search system powered by Ajax

Advanced visual search system powered by Ajax

ITR Form 6, or Income Tax Return Form 6, is used by companies to e-file their income tax returns. It is useful for companies not seeking exemptions under Section 11 of the Income Tax Act, 1961. However, certain companies, particularly those generating income from property for charitable, spiritual, or religious purposes, are excluded. Form 6 is exclusively electronic and requires a digital signature as the confirmation seal.

Since 2017-2018, individuals face a ₹10,000 fine under Section 234F for not filing income tax returns within the specified timeframe. The penalty is lowered to ₹1,000 for those with a 5 lakh annual income.

ITR receipt is a comprehensive proof of income and tax payment, encompassing various sources.

Financial institutions require ITR receipts for past three years for loans, making timely tax returns crucial for financial validation.

Advanced visa processing requires past years' ITR receipts, ensuring tax compliance and travel expenses for better visa prospects.

Filing ITR within timeframe allows forwarding losses to future fiscal years, making timely filing crucial for maximizing benefits.

Irrespective of their formation under the Companies Act 2013 or the earlier Companies Act 1956, all companies must file their Income Tax Return via Form ITR-6.

Companies bound to file Form ITR-6 must possess an audit statement under Section 44-AB. This entails a financial audit by a Chartered Accountant if the business's turnover exceeds INR 1 Crore.

However, companies deriving income from religious or charitable trusts are exempted from filing Form ITR-6 under Section 11.

From both post offices and banks.

Offering insights into income and taxes.

Details of capital gains.

A crucial component.

A personal identification essential.

Supporting the income details.

For investment proof

Details if applicable.

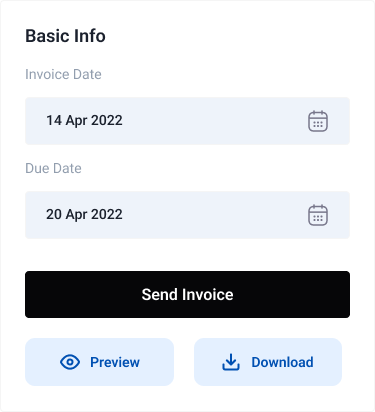

The journey of ITR-6 filing involves the following stages:

Initiate the process with your digital signature.

Provide essential information through schedules.

Affix your confirmation under the ITR V form.

Navigating the labyrinth of tax filing is simplified through Fincto’s streamlined process:

Agents efficiently collect data

Your return is meticulously prepared.

File-ready return ready for submission before you realize it.

Accompanying these segments are 31 schedules, each serving a distinct purpose, including:

Computes income through housing property as the primary source

Calculates machinery and plant depreciation as per Income Tax Act norms

Computes revenue under the 'profit and income from business or profession' category

Evaluates depreciation linked to other assets

Determines deemed capital gains upon the sale of depreciable assets

Enlists depreciation details for all properties as per the Income Tax Act

Covers Section 35 tax deduction related to scientific research expenses

Computes income from other sources

Calculates income from capital gains

Reports income after deducting current-year losses

And many more...

Reflects the increased tax audit ceiling from ₹5 crores to ₹10 crores (where cash transactions are under 5% of total transactions)

Schedule a tax consultation with our experts to address your queries.

Tax experts file Form ITR-2 online, keeping you informed about progress.

Provide necessary information to experts for paperwork handling.

Notifications for minors' safety and well-being.

Registered post notices comply with 1897 General Clauses Act 27.

Refused acknowledgment notices affixed to residences or workplaces.

Notifications sent to managers or relevant members.

Notifications sent to liable individuals.

Fincto's tax experts assist in filing efficiently.

Platform optimized for easy navigation and hassle-free experience.

Competitive pricing ensures value for investment.

In-house experts review information with precision, minimizing errors.

Experts provide comprehensive support for queries and filing processes.

GSTR1 is the form used for tax returns on outward supplies, encompassing both interstate and intrastate B2B and B2C sales. It also includes details of purchases under reverse charge and inter-state stock transfers made during the tax period. Late filing of GSTR1 can result in a late fee, which is collected in the subsequent open return, Form GSTR-3B. Since January 1, 2022, taxpayers cannot file Form GSTR-1 if they haven't filed Form GSTR-3B in the preceding month.

This amendment form corrects any discrepancies between the GSTR-1 of a taxpayer and the GSTR-2 of their customers. The filing window for GSTR1A is between the 15th and 17th of the following month.

Monthly GST returns for inward supplies are filed using this form. It contains taxpayer information, return period, and detailed invoice-level purchase information related to goods and services separately.

This auto-generated tax return compiles purchases and inward supplies made by a taxpayer based on the information from their suppliers GSTR-1.

An auto-generated document that acts as an Input Tax Credit (ITC) statement for taxpayers, facilitating faster return filing, minimizing errors, easing reconciliation, and simplifying compliance.

This form is used to file consolidated monthly tax returns. It contains the taxpayers basic information, turnover details, final aggregate-level inward and outward supply details, tax liability under CGST, SGST, IGST, additional tax (+1% tax), ITC, cash, liability ledgers, and details of other payments like interests, penalties, and fees.

This is a tax notice issued by the tax authority to a defaulter who has failed to file monthly GST returns on time.

It is a temporary consolidated summary GST return for inward and outward supplies, introduced as a relaxation for recently registered businesses.

This quarterly GST return is filed by compounding vendors. It includes the total value of supplies made during the covered period and details of tax paid at the compounding rate (not exceeding 1% of aggregate turnover) along with invoice details for inward supplies.

The Quarterly purchase-related tax return filed by composition dealers, automatically generated by the GSTN portal based on information from the suppliers GSTR-1, GSTR-5, and GSTR-7.

Variable return for Non-resident foreign taxpayers, containing details of the taxpayer, return period, and invoice details of all goods and services sold and purchased. It also includes imports on Indian soil for the registered period/month.

This monthly GST return is for ISDs (Input Service Distributors), containing details of invoice-level supply from the GSTR-1 of counterparties, credit for ITC services received, debit for ITC reversed or distributed, and closing balance.

It is a monthly return for TDS (Tax Deducted at Source) transactions, containing the taxpayers basic information, return period, supplier's GSTIN, and invoices against which the tax has been deducted, categorized under SGST, CGST, and IGST. It also includes details of other payments like interests and penalties.

This is the monthly return for e-commerce operators. It contains the taxpayers basic information, return period, details of supplies made to customers through the e-commerce portal, tax collected at source, tax payable, and tax paid.

The annual consolidated tax return, comprising detailed income and expenditure, regrouped according to the monthly GST returns filed by the taxpayer.

The annual composition return form to be filed by every taxpayer enrolled in the composition scheme.

This Audit form is filed by taxpayers liable to get their annual reports audited when their aggregate turnover exceeds ₹2 crores in a financial year.

Filed before cancelling GST registration, this final GST return contains the details of all supplies, liabilities, tax collected, and tax payable.

Variable tax return for taxpayers with UIN (Unique Identification Number), containing details of purchases made by foreign embassies and diplomatic missions for self-consumption during a particular month.

Navigate tax maze confidently with Fincto’s streamlined ITR-5 filing experience

Staying compliant with GST due dates is vital to avoid late payment charges and interests. Fincto provides updated information on due dates for the financial years 2021-2022 and 2022-2023. Keeping clients informed of these updates can help taxpayers stay on top of their compliance requirements and ensure timely filing of GST returns.

Taxpayers registered under the Composition Scheme must file taxes using CMP-08 every quarter and file GSTR-4 annually. The due date for the GST return for Composition Scheme registrants is the 18th of the month following each quarter.

Fincto provides a hassle-free GST return filing experience with the support of a team of dedicated experts. Fincto offers a seamless GST compliance journey. It's commendable to see such dedication to assisting taxpayers in their GST return filing processes.

A GST Certificate is an important document issued by the Indian government which proves that a business is registered under GST. The certificate contains crucial information like the GST identification number, name, and address of the business. With a GST Certificate on hand, businesses can easily charge and collect GST, apply for loans, and participate in tenders.

GST tax rates can range from 0% to 28% depending on the type of goods or services. essential items being taxed at 0%, while luxury items and certain services fall under the 28% bracket, gold is taxed at 3%, and crude oil and natural gas at 6%.Rates may vary, so it Is essential to check the current rates before transactions.

GSTIN (Goods and Services Tax Identification Number) is a unique identification number given to each GST taxpayer. It is used to verify GST registration on the GST portal.

According to Section 122 of the CGST Act, there is a direct penalty for taxable persons failing to register for GST online.

Companies with turnover below ₹20 lakhs can voluntarily register for GST, enjoying advantages like input credit, inter-state selling with no restrictions, registering on e-commerce platforms, and gaining a competitive edge.

GST return filing is the process of submitting details of sales, purchases, and taxes to the government. All registered taxpayers under GST must must file returns regularly, regardless of transactions during the period.

Fincto, India’s premier tax assistance platform, offers unparalleled advantages.Our tax experts provide seamless guidance, an easy-to-navigate interface, competitive pricing, error-free assurance, and comprehensive support for filing and queries. They ensure value for investment, minimize error risks, and provide error-free assurance. Make informed decisions in the realm of taxation. Opt for Fincto for ITR-6 filing that spells precision and ease.

A modification to the existing provisions of a corporation's articles of incorporation

Issued by certifying authorities for electronic document signing.

The elected governing body responsible for a corporation's operation. Certificate of Incorporation: The document filed to create a corporation

A unique identification number for directors. Dissolution: The process that legally ends a corporation's existence

The act of forming a corporation under specific jurisdiction laws

An entity with limited personal liability and pass-through taxation

Protection from the debts and claims against a company

The process to secure exclusive use of a corporate name for a specific period

The statutory address of a corporation

Mattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Gerry Kellmen

Head of financeMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Johnson

WordPressMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Maxwell

PHP DeveloperMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Anderson

Head of financeBanca is a leading bank in the worldzone and a prominent international banking institution

COTATION

2023-01-05 14:00 (INTERNATIONAL TIME)