Did You Know?

Fincto turns out that context is a key part of learning.

Fincto turns out that context is a key part of learning.

To close an LLP, follow legal procedures, including filing a resolution with the Registrar of Companies, submitting a statement of assets and liabilities, and a valuation report. Most partners must declare no debts or pay off all debts within a specified period, not exceeding one year from winding up

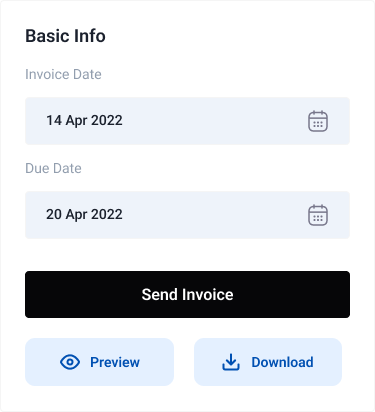

LLPs must comply with mandatory returns and close down if not filing, as penalties can result. Fincto is a popular service provider for LLP registration and closure. LLPs must be inactive for at least one year and not have assets at the time of application. Closing involves submitting an application, fees, affidavit, IT return, and Statement of Accounts. The closure process may take up to two months, depending on partners’ completion of necessary procedures.

Checklist for Closing Down an LLP:

Transforming LLP agreement with Fincto involves three simple steps.

To change the company name, the following documents need to be filed:

File Form 24 with the Registrar of Companies, along with a declaration from the partners, indemnity bonds, and an affidavit stating the information's accuracy.

The Registrar of Companies will publish a notice on its website, stating the application's contents, for one month.

After one month, the Registrar of Companies will remove the LLP's name from the register and publish a notice in the Official Gazette, legally closing/dissolving the LLP.

Changes to LLP agreement may be necessary due to various reasons.

Business growth impacts capital needs, requiring adjustments in sharing and profit ratios.

Partners' roles and responsibilities may change over time, requiring modifications.

Modifications to administrative powers and activities to meet evolving business needs.

Changes may be necessary for clauses like jurisdiction, resignation, appointment, partnership duration.

Partners need to submit the following documents for LLP closure:

Changing the company’s name does not alter any existing rights or obligations of the company. The company’s prior name will not have any impact on any legal actions already started or ones it is now facing.

However, after the new name has been officially registered with the Registrar of Companies (RoC), any new legal proceedings in the company’s former name will be invalid, and the company’s old name should be considered non-existent. Despite the name change, the company’s legal structure is unaltered.

The approval of the company name is an essential stage in renaming your business. This procedure is requesting formal approval from the appropriate authorities, often a government body in charge of registering and overseeing businesses in a particular territory. The goal of name approval is to make sure the new company name is original and hasn’t been taken by another company. It must also adhere to all rules and regulations established by law in that region.

The procedure for Private Limited Company Name Approval, for instance, will follow the same guidelines if you are operating as a Private Limited Company and want to make sure the new name complies with all legal requirements.

when changing the registered office address, it is crucial to file Form INC-22 along with the requisite fees. The following documents need to be submitted for verification:

The board must approve a director’s company relocation to their property, submit necessary paperwork, and submit Form INC-22 for the MCA to initiate the change.

Choosing Fincto for changing your company name comes with several advantages:

We've designed an efficient and straightforward process to make the name change seamless and time-saving for you.

Our expert team will verify the availability of your proposed name before proceeding with the legal formalities.

We take care of drafting the necessary documents, filling out forms, and handling the entire filing process on your behalf.

We make sure all required changes are made to your Memorandum of Association and Articles of Association.

Our dedicated support team is always ready to address your queries and provide assistance throughout the name change process.

Fincto is your go-to partner when it comes to renaming your business since we make the process easy and provide professional advice at each stage. Let us handle the details so you can concentrate on choosing a name that will help your company develop.

The process for changing the company objectives involves five key steps:

The company's name and objectives will be altered through a board meeting, with a director or secretary appointed to sign and certify the necessary documents.

File Form MGT-14 with the RoC, along with the necessary documents, to process the changes.

After receiving the new incorporation certificate, update the object clause in all copies of the MoA.

The committee is planning to hold an Extraordinary General Meeting (EGM) to approve changes, ensuring all members are given proper notice and their responses are collected.

If the Company Identification Number (CIN) changes due to a change in the industry code, the RoC will issue a new certificate of incorporation to the company.

The process of liquidation is governed by several regulations and acts, including:

The act outlines the circumstances under which a company can be shut down, including special resolutions, acts against the country's sovereignty, court findings, failure to file yearly returns, and more.

This code deals with the voluntary liquidation of companies through special resolutions passed by board members.

Directors must submit KYC information to MCA if they meet recent updates.

The Ministry of Corporate Affairs offers the 'Strike Off' mechanism for inactive businesses, which can be initiated voluntarily through specific resolutions or court orders.

This method, available under Section 248 of the Companies Act of 2013, is a quick and straightforward way to dissolve a defunct company.

For companies seeking to change their registered office address from one state to another, the process involves the following steps:

The Board of Directors is required to adopt a resolution requesting an EGM to discuss and pass a special resolution for changing the registered office and modifying the Memorandum of Association.

The company must publish a notice in a newspaper, notify debenture holders, creditors, and depositors within 21 days, apply to the Regional Director using Form INC-23, and receive confirmation within 60 days.

The company is required to obtain approvals from the Regional Director and Central Government within 60 days, using Form INC-22 and INC-28, to confirm the office change.

Private limited companies must prioritize annual compliances, ensuring filings meet due dates and adhering to prescribed guidelines

Manage company income, expenditure, and monitor managerial policies effectively.

Assess business performance using key metrics like net profit.

Monitor business finances for effective project planning and financial management.

Assess a business's financial health and credibility for investors.

Registrar of Companies mandates income tax compliance, avoiding fines.

The Director Identification Number (DIN) is a crucial identifier for aspiring and current directors in corporate governance. Obtaining a DIN requires a one-time application through eForm DIR-3. An annual requirement has been introduced, requiring directors with DINs to submit KYC details annually through fincto’s expertise.

THIS FOUNDERS’ AGREEMENT (hereinafter referred to as the ‘Agreement’) is executed on [DD/MM/YYYY] by and among [XXXX] (the ‘Company’), and the following founders (the ‘Founders’):

[Insert Founder Name]

[Insert Founder Name]

NOW, WITH DUE CONSIDERATION to the foregoing and the mutual covenants and agreements hereinafter detailed, the parties hereto concur as follows:

[Continuation of the founders agreement template, incorporating company information, initial capital, ownership structure, vesting schedule, intellectual property rights, amendment protocols, resignation procedures, confidentiality commitments, dispute resolution, and more.]

Fincto combines technology and legal expertise for thousands of legal tasks.

Government processes simplified for convenience.

Package includes two iterations for satisfaction.

Fincto simplifies legal processes, making them accessible and accessible.

For comprehensive guidance, expert consultation is recommended.

A founders agreement encompasses several pivotal sections, including:

We handle legal work for over 1000 companies and LLPs each month, utilizing our tech capabilities and expertise of our legal professionals, ensuring ease and convenience for our clients.

We provide clarity on the incorporation process, setting realistic expectations and handling all paperwork to ensure a seamless interactive process with the government.

With a team of over 300 experienced business advisors and legal professionals, we offer top-notch legal services.

We stay up-to-date with regulatory changes, such as the new rules for winding up companies, ensuring our clients receive accurate and timely services.

When it comes to closing down an LLP, Fincto is a trusted partner for closing an LLP, providing comprehensive support and guidance. Let us handle the legal complexities while you focus on the next chapter of your business journey.

Customer may receive a refund for product dislike, damaged, incorrect item, or predefined issues upon return.

Refund policy governs online order cancellation process, details, and procedures for refunds.

A Website Disclaimer communicates liabilities to visitors, safeguards intellectual property, discourages unauthorized usage, and prevents misuse accusations. It can be standalone or integrated into legal documents, demonstrating responsible online conduct and promoting responsible behavior.

A Cookie Policy is essential for online transparency and legal compliance, educating visitors about active cookies, their purpose, and user data processing. It is often a legal requirement in many jurisdictions.

E-commerce relies on efficient shipping and delivery; a Shipping Policy provides clear information on fees, timelines, and procedures, improving customer experience.

GSTR1 is the form used for tax returns on outward supplies, encompassing both interstate and intrastate B2B and B2C sales. It also includes details of purchases under reverse charge and inter-state stock transfers made during the tax period. Late filing of GSTR1 can result in a late fee, which is collected in the subsequent open return, Form GSTR-3B. Since January 1, 2022, taxpayers cannot file Form GSTR-1 if they haven't filed Form GSTR-3B in the preceding month.

This amendment form corrects any discrepancies between the GSTR-1 of a taxpayer and the GSTR-2 of their customers. The filing window for GSTR1A is between the 15th and 17th of the following month.

Monthly GST returns for inward supplies are filed using this form. It contains taxpayer information, return period, and detailed invoice-level purchase information related to goods and services separately.

This auto-generated tax return compiles purchases and inward supplies made by a taxpayer based on the information from their suppliers GSTR-1.

An auto-generated document that acts as an Input Tax Credit (ITC) statement for taxpayers, facilitating faster return filing, minimizing errors, easing reconciliation, and simplifying compliance.

This form is used to file consolidated monthly tax returns. It contains the taxpayers basic information, turnover details, final aggregate-level inward and outward supply details, tax liability under CGST, SGST, IGST, additional tax (+1% tax), ITC, cash, liability ledgers, and details of other payments like interests, penalties, and fees.

This is a tax notice issued by the tax authority to a defaulter who has failed to file monthly GST returns on time.

It is a temporary consolidated summary GST return for inward and outward supplies, introduced as a relaxation for recently registered businesses.

This quarterly GST return is filed by compounding vendors. It includes the total value of supplies made during the covered period and details of tax paid at the compounding rate (not exceeding 1% of aggregate turnover) along with invoice details for inward supplies.

The Quarterly purchase-related tax return filed by composition dealers, automatically generated by the GSTN portal based on information from the suppliers GSTR-1, GSTR-5, and GSTR-7.

Variable return for Non-resident foreign taxpayers, containing details of the taxpayer, return period, and invoice details of all goods and services sold and purchased. It also includes imports on Indian soil for the registered period/month.

This monthly GST return is for ISDs (Input Service Distributors), containing details of invoice-level supply from the GSTR-1 of counterparties, credit for ITC services received, debit for ITC reversed or distributed, and closing balance.

It is a monthly return for TDS (Tax Deducted at Source) transactions, containing the taxpayers basic information, return period, supplier's GSTIN, and invoices against which the tax has been deducted, categorized under SGST, CGST, and IGST. It also includes details of other payments like interests and penalties.

This is the monthly return for e-commerce operators. It contains the taxpayers basic information, return period, details of supplies made to customers through the e-commerce portal, tax collected at source, tax payable, and tax paid.

The annual consolidated tax return, comprising detailed income and expenditure, regrouped according to the monthly GST returns filed by the taxpayer.

The annual composition return form to be filed by every taxpayer enrolled in the composition scheme.

This Audit form is filed by taxpayers liable to get their annual reports audited when their aggregate turnover exceeds ₹2 crores in a financial year.

Filed before cancelling GST registration, this final GST return contains the details of all supplies, liabilities, tax collected, and tax payable.

Variable tax return for taxpayers with UIN (Unique Identification Number), containing details of purchases made by foreign embassies and diplomatic missions for self-consumption during a particular month.

The MCA introduced The Companies (Winding up) Rules, 2020, effective April 1, 2020, to streamline company winding up procedures for smaller companies, eliminating tribunal intervention and applicable to specific classes under Section 361 of the Companies Act, 2013. Fincto is a customer-centric service provider with a team of experts who stay updated on legal landscape updates. They handle company winding-up processes with precision and compliance, adhering to MCA rules. Fincto’s commitment to excellence and attention to detail sets them apart as a reliable choice for business closure needs.

Staying compliant with GST due dates is vital to avoid late payment charges and interests. Fincto provides updated information on due dates for the financial years 2021-2022 and 2022-2023. Keeping clients informed of these updates can help taxpayers stay on top of their compliance requirements and ensure timely filing of GST returns.

Taxpayers registered under the Composition Scheme must file taxes using CMP-08 every quarter and file GSTR-4 annually. The due date for the GST return for Composition Scheme registrants is the 18th of the month following each quarter.

Fincto provides a hassle-free GST return filing experience with the support of a team of dedicated experts. Fincto offers a seamless GST compliance journey. It's commendable to see such dedication to assisting taxpayers in their GST return filing processes.

A GST Certificate is an important document issued by the Indian government which proves that a business is registered under GST. The certificate contains crucial information like the GST identification number, name, and address of the business. With a GST Certificate on hand, businesses can easily charge and collect GST, apply for loans, and participate in tenders.

Fincto connects users with industry experts, including verified lawyers, to ensure satisfaction with their records. They track progress and provide transparency, with clients praising their clear legal requirements and regular updates.

Fincto offers a seamless, efficient process for modifying LLP agreements, allowing flexibility in adapting to changing business landscapes.

A modification to the existing provisions of a corporation's articles of incorporation

Issued by certifying authorities for electronic document signing.

The elected governing body responsible for a corporation's operation. Certificate of Incorporation: The document filed to create a corporation

A unique identification number for directors. Dissolution: The process that legally ends a corporation's existence

The act of forming a corporation under specific jurisdiction laws

An entity with limited personal liability and pass-through taxation

Protection from the debts and claims against a company

The process to secure exclusive use of a corporate name for a specific period

The statutory address of a corporation

Mattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Gerry Kellmen

Head of financeMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Johnson

WordPressMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Maxwell

PHP DeveloperMattis turpis in suspendisse sed risus nulla adipiscing augue pellentesque nam mi tellus consectetur

Anderson

Head of financeBanca is a leading bank in the worldzone and a prominent international banking institution

COTATION

2023-01-05 14:00 (INTERNATIONAL TIME)